“Ethiopia-China friendship is strong and unbreakable” – Chinese Foreign Minister, Wang Yi.

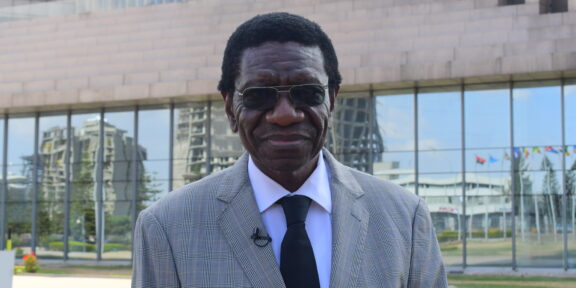

Ethiopian Deputy Prime Minister and Foreign Minister Demeke Mekonnen and Chinese Foreign Minister Wang Yi held a joint press conference. He said China opposes any attempt to interfere in Ethiopia’s internal affairs as Ethiopians have the ability to solve their own problems and stabilize the situation on their own.

Demeke said he is happy that Wang Yi has arrived in Addis Ababa in a safe and secure environment. He praised China’s strong commitment to Ethiopia’s sovereignty and territorial integrity.