African countries should harness responsible creation, adoption and use of 4th industrial revolution technologies for economic transformation in an era of shrinking development financing. This is the view of technology experts gathered at a plenary session on digital transformation for effective development financing system in Africa in Sal, Cabo Verde. They agreed that this will require good policies to ensure that innovations created in their countries are sustainable, efficient and market driven.

Philip Thigo, Digital Partnerships Advisor, and Lead, Africa Leading the 4th Industrial Revolution at the UNDP said “Technology is enabling the rapid societal transformation, simplifying the already existing digital divide but it is creating threats to the very fabric of democracy and sustainable development.”

Mobile solutions are boosting financial inclusion in Africa, pushing the banking penetration rate on the continent from less than 20% in 2015, to more than 40% today.

Experts say the most dynamic segment in Africa’s start-up boom has seen fintech firms raise US$836 million in capital in 2019, compared with US$379 million in 2018. They are fast-tracking financial inclusion on a continent where there are only five bank branches per 100,000 people, in contrast to 13 in other parts of the world. However, as seen with the explosion of online lending platforms in Kenya, this growth comes with a number of risks.

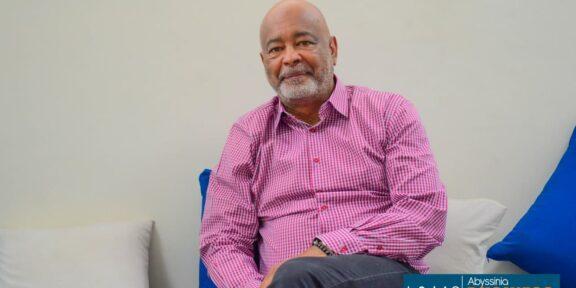

Omar Cissé, founder and Chief Executive Officer of InTouch in Senegal, said technology firms in Africa need money to digitise their systems. And international organisations should stop giving money to states to digitise, but rather give it to Fintech.

He said in 2010 he created CTIC Dakar, a leading business incubator in Senegal for IT and mobile services entrepreneurs.

“We developed a solution that allows payment in whatever form and money transfers. In 2013 CTIC accompanied hundreds of entrepreneurs and is today a reference for firms support in Africa. With partners that helped build it, the CTIC experience is currently being duplicated in several African countries,” said Cissé.

The panellists all agreed that the Covid-19 crisis has accelerated the pace of digitalisation in the continent. Fintech can be the solution that helps transform the continent’s financial systems by adapting financing tools which reflect the reality of African economies dominated by the informal sector. The 2021 African Economic Conference began on Thursday, December 2, with the theme: ‘Financing Africa’s Post COVID-19 Development’.