By Daniel Tiruneh

Well-known that Ethiopian insurance in its modern form began in 1905 when the then Bank of Abyssinia which was owned by the Bank of Egypt began to transact as an agent of foreign insurance company which would underwrite fire and marine insurance policies in Ethiopia.

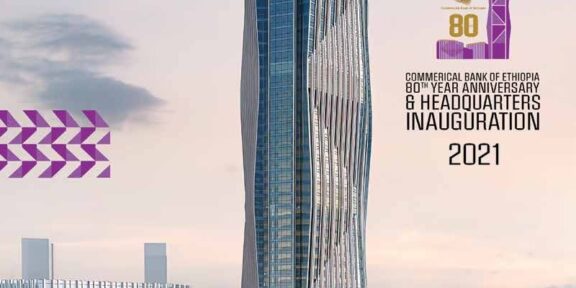

Established on January 1st 1976, the Ethiopian Insurance Corporation (EIC) renders now over 30 types of non-life insurance policies, which are used to cover property and liability risks because. It also revises its policies regularly and produces new policies based on the country’s current economic development and the demand of customers.

ABN meets the Ethiopian Insurance Corporation CEO, Netsanet Lemessa and discusses issues on corporation’s performance and its contribution to the construction of the Grand Ethiopian Renaissance Dam (GERD). Netsanet has been serving the corporation at different positions for about 22 years.

Netsanet served the Corporation as Nekempt Branch Manager for two years, and left for Germany to attend a six-month scholarship in General and Life insurance in German. Coming back home, he had worked at EIC Diredawa branch for four years before he became EIC CEO in 2016.

As an Ethiopian citizen I am eager to see the completion of the Dam.

I strongly feel that we will complete the project within the specified period despite external pressure. So we need to strengthen our unity more than ever to build the nation, leaving our political differences aside.

The Ethiopian Insurance Corporation (EIC) is one of the country’s financial institutions, playing significant role in the socio-economic development being undertaken across the country. It is providing different insurance policies, including endowments, whole life and medical insurance and pre-funeral expense insurance, among others.

Envisaging being a world-class insurer by the year 2025, the Ethiopian Insurance Corporation provides more than 30 types of non-life insurance policies, which are used to cover property and liability risks. The Corporation revises its policies on regular basis, and produces new policies in line with the nation’s existing economic situation.

According to Netsnet Lemessa, EIC CEO, the Corporation has been working on preparation of new insurance policies such as floriculture, condominium, tea and coffee, weather-index crop insurance, and warehouse operators’ liability insurance, adding that the major property and liability insurance services given by the Corporation are all risks.

The Ethiopian Insurance Corporation had been the only state-owned insurance company before 1993, but with the introduction of new national financial strategies and policies, private insurers began to appear in the market. This, according to Netsanet, paves ways to boost the performance of the company for competitive environment in the sector has been created.

“As an Ethiopian citizen I am eager to see the completion of the Dam. I strongly feel that we will complete the project within the specified period

despite external pressure. So we need to strengthen our unity more than ever to build the nation, leaving our political differences aside.”

Currently the Corporation is making considerable amount of financial gain, stretching its wing to nearly 100 branches across the country. It is also becoming a multi-billion compensation payer and trillion insurance coverage provider company.

The CEO underlined the need to enter the international market through enhancing its technological application and expansion as well as development of human resource. He recalled that the Corporation used to receive foreign insurance, as co-insurer, but that didn’t work. As a result, the Company was compelled to cease the operation, which it will reconsider resuming in the future.

It is becoming increasingly challenging for insurance companies to survive in their current form. Netsnet pointed out that although the Corporation is doing its best, there are challenges to enjoy fair play in the sector. Unethical competition, the increasing demand gap between the multi-generation customer bases, the fast-changing digital space, systems and technologies, and lack of governance remain the biggest obstacles to move fast-forward in the market.

Netsanet noted that the only financial sector that doesn’t show any inflation in Ethiopia is the insurance industry, adding that due to small coverage and limited financial resource, insurance premium is usually slowing down instead of rising.

The CEO further stated that EIC has facilitated and rendered a 56-billion birr insurance coverage for the civil works of the Dam being undertaken by the Italian-based construction company, Sallini. Moreover, he said that after the revision of the electromechanical work of the project, the Corporation has managed to render insurance service for Chinese companies that are undertaking the specific task.

As an Ethiopian organization, EIC has so far bought a 150-million birr bond for the construction of the Renaissance Dam while employees of the Corporation bought bonds in three rounds and the management in four rounds.

“As an Ethiopian citizen I am eager to see the completion of the Dam. I strongly feel that we will complete the project within the specified period despite external pressure. So we need to strengthen our unity more than ever to build the nation, leaving our political differences aside.” Netsnet explained.